Chinese timber industry: Wood Guangzhou conference materials

WhatWood analytic agency published materials of the conference held on 12 May in the framework of Wood Guangzhou exhibition in China. Among the speakers were Chinese businessmen and officials, as well as Norvik Timber CEO Sampsa Auvinen and WhatWood editor Kirill Baranov, who told about the markets of Europe and Russia, respectively. Below is the brief resume of the article. Full version is available in the recent issue of Russian Timber Journal.

Fu Jianquan, the head of Planning and Fund Management Division, State Forestry Administration of China, spoke about Chinese foreign investments into the timber industry. The volume of already allocated assets stands at $1.3 billion, and projects are implemented in 20 countries, mainly in logging and primary processing as well as furniture production. The investment pattern becomes more complicated over time, with companies attracting banks and raising the proportion of further processing.

Zhang Jian, the head of Academy of Forestry Inventory and Planning, State Forestry Administration of China, complemented the information on foreign investments. According to him, the Northern province of Heilongjiang is leading in international investments: 177 projects worth $2.53 billion are under way, most of them implemented in Russia.

Qian Xiaoyu, Vice-chairman of China National Forest Product Industry Association, presented country’s panel industry. The volume of wood-based panels output in China in 2013 amounted to 236 million m3, which is 5.83% higher than previous year’s value. Country’s share in the world market is 57.56%, while just eight years ago it was hardly over 25%.

Sales of real estate in the country reached 1.31 billion m2 last year, which is 17.3% higher than in 2012. Sales in the residential segment increased by 17.5% to 1.16 billion m2, in the office segment – by 27.9% to 28.8 million m2, in the commercial segment – by 9.1% to 84.7 million m2. The total area of real estate under construction was 6.66 billion m2. The most dynamic growth of construction is registered in the maritime provinces of China.

Chinese forest industry is not a gold mine, both mergers and bankruptcies happen there. Recently local companies started investing more into foreign assets. This is because the Chinese government has taken more environmental approach and hinders non-sustainable growth of the industry. In particular, outdated capacities are forced to close. The average profitability of the large Chinese forest holdings in 2013 amounted to 6.1%.

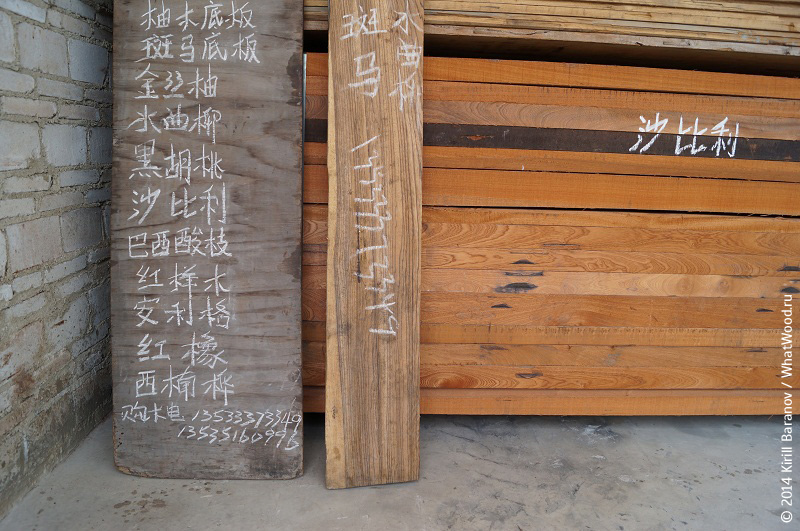

Zhao Jun, Director of BNBM Group, reported on the latest price trends in China. In the spring of 2014, prices for roundwood and sawn timber from Russia declined, as the port inventories rose. Information on the decrease in prices of imported coniferous wood is confirmed by the index of Yuzhu timber market, located in Guangzhou. The index for domestic pine lumber, on the contrary, grows gradually.

According to Zhao Jun, excess capacity has a negative impact on the economy, and under absence of innovation, tightening credit conditions and numerous international risks, this leads to a difficult financial situation of the Chinese timber manufacturers and builders. The devaluation of the yuan exacerbates this trend. In the first quarter of 2014, the year-on-year growth of China’s GDP was 7.4%, a record low since the crisis of 2008.

Wu Shengfu, Vice-chairman of China National Forest Product Industry Association, spoke about international trade conflicts. On the one hand, he admitted that the Chinese market is characterized by disorderly competition and the lack of rules in the market. However, the international rules of the game, he said, are formed by Western companies, and this affects badly Chinese trade opportunities.

Norvik Timber CEO Sampsa Auvinen told about the European timber market. Despite some improvements, the demand in Europe will remain low for many years, predicts Auvinen. The gap in consumer sentiment between the North and the South of Europe is gradually decreasing at the same time. Presently European companies can rely on sales into the Middle East countries. Japanese sawn timber market this year is predicted to curtail by 10.8% to 6.93 million m3.

The Russian forest industry last year has found its points of growth: export demand for sawn timber, birch plywood and pellets, as WhatWood editor Kirill Baranov told in his report. WTO accession has not led to growth in wood exports to China, as the complicated system of duties remained in place. For instance, the duty on larch wood has not changed and remained at the level of 25%. Compulsory single-piece marking of valuable hardwood species will lead to further decline in exports. Large Far East holdings are now lobbying compensation of roundwood export duties on timber; on the other hand, the Russian government intends to cancel VAT return for exporters of round timber.

In the biofuel sector, government subsidies can lead to a rapid development of the domestic market. In the export segment, South Korea is interesting. Meanwhile, pellet plants ready to meet this demand are almost absent in the Far East, while container deliveries from the European part of Russia are not economically feasible, WhatWood editor concluded.

Several companies participating in the exhibition have confirmed that India will become the next interesting sales market: in this country, young middle class is developing rapidly, which will form the basis of growth. At the Wood Guangzhou fair, some companies have suddenly found customers from India.

To read the full article, please subscribe for the digital Russian Timber Journal.

Timber industry research & analytics

Timber industry research & analytics

1 review

Yanooka пишет:

08 May 2015

Good article! I want to say that timber plant residues are also very useful. Wood Pellet Plant can make timber wastes and sawdust into high quality wood pellet fuel. If anyone is interested in build a pellet production line, you shoule consider about GEMCO Pellet Line.